In today’s fast-paced world, managing finances and splitting bills has become a part of our daily routine. As technology evolves, so do the ways we handle our expenses. Traditional payment apps have long been the go-to solution, but a new contender has entered the arena – Youchamp. In this blog, we embark on a comparative journey between Youchamp and traditional payment apps, uncovering how Youchamp is reshaping financial management and enhancing the way we handle group expenses.

Traditional Payment Apps:

Traditional payment apps have long been the staple for managing financial transactions. They typically offer functional yet straightforward interfaces that facilitate basic payment transfers, bill payments, and expense tracking. These apps are designed to streamline individual transactions, enabling users to send money to friends, family, and businesses with ease. However, they often lack features that cater to more complex financial scenarios, such as detailed bill splitting among groups, integrated communication options, and specialized solutions for businesses. While these apps provide a means of conducting transactions, they may not fully address the evolving needs of users in terms of seamless group expense management, fundraising, and enhanced security features. As technology advances and user expectations grow, traditional payment apps face competition from innovative solutions like Youchamp that are redefining the landscape of financial interactions.

Youchamp’s Take on new financial management

User Interface: A Fresh Take on Simplicity

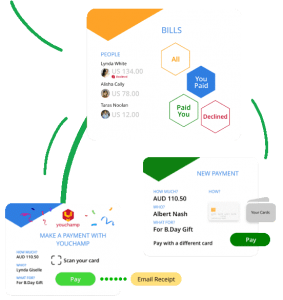

Traditional payment apps often follow a functional yet somewhat clunky design. Youchamp, on the other hand, offers a breath of fresh air with its intuitive and user-friendly interface. Navigating through its features feels like a breeze, making the process of splitting bills and managing group expenses an enjoyable experience.

Group Expenses: From Chaos to Clarity

Imagine a group dinner where everyone’s trying to split the bill, but confusion reigns supreme. Traditional payment apps provide basic bill-splitting options, but they often lack the finesse needed for complex scenarios. Youchamp steps in with its advanced algorithms, effortlessly handling multi-item bills and intricate expense distributions. No more manual calculations or headaches – Youchamp does the heavy lifting for you. View our social expense management page.

Communication Integration: Beyond Payments

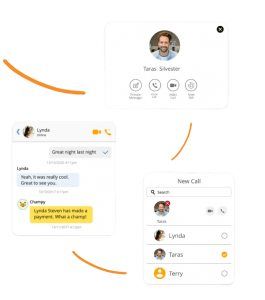

While traditional payment apps focus solely on transactions, Youchamp introduces a whole new dimension of interaction. Its integrated voice and video calling features enable you to discuss expenses with your group directly within the app. No more jumping between platforms – Youchamp brings everything under one roof.

Fundraising with Heart

Traditional payment apps might process transactions, but they miss the heartwarming aspect of fundraising. Youchamp understands the importance of causes close to your heart. Its fundraising feature empowers you to raise funds effortlessly, all while retaining 100% of the contributions. Whether it’s for a charity, a personal project, or a community event, Youchamp turns every transaction into a chance to make a difference. Start the fundraising immediately.

Businesses, Rejoice!

Businesses often grapple with transaction fees, impacting their bottom line. Youchamp steps up as a game-changer with its business payment system. Say goodbye to exorbitant EFTPOS and transaction charges – Youchamp’s business solution helps you save money that can be better utilized for growth and expansion.

Security: Your Peace of Mind

While traditional payment apps have encountered their share of security breaches, Youchamp raises the bar in safeguarding your financial data. Utilizing state-of-the-art encryption and stringent security protocols, Youchamp ensures that your transactions and personal information remain shielded from prying eyes. With Youchamp, your peace of mind is as much a priority as your financial transactions.

In Conclusion: A Paradigm Shift in Financial Management

As we bid farewell to the era of traditional payment apps, we usher in a new era of financial management with Youchamp. Its innovative features, seamless interface, and commitment to enhancing both individual and group financial experiences set it apart. From streamlined bill splitting to impactful fundraising, Youchamp isn’t just an app; it’s a revolution in how we handle money.

In a world where convenience and innovation reign supreme, Youchamp emerges as the trailblazer, redefining the way we interact with our finances. Say goodbye to the mundane and embrace the extraordinary – the world of Youchamp awaits.

Why Youchamp Excels Over Traditional Payment Systems:

Youchamp presents a groundbreaking shift in the way we manage finances, offering a range of features that set it apart from traditional payment systems. Unlike conventional apps, Youchamp provides an intuitive user interface that not only simplifies transactions but also engages users with its visual appeal. The advanced algorithms of Youchamp enable effortless splitting of complex expenses, making it a game-changer for group transactions. Moreover, its integration of voice and video calling fosters real-time communication within the app, a dimension often missing in traditional systems.

One of Youchamp’s standout features is its fundraising capability, allowing users to initiate campaigns and retain 100% of contributions, transcending the transactional nature of traditional systems. Additionally, businesses find solace in Youchamp’s specialized payment system that reduces EFTPOS and transaction fees, directing funds toward growth rather than overhead.

Security, a paramount concern, is addressed with Youchamp’s stringent encryption and data protection protocols, elevating it above the security limitations of traditional systems. The summarized superiority of Youchamp lies in its holistic approach to financial interactions, integrating convenience, transparency, communication, fundraising, and security in a manner that surpasses the capabilities of traditional payment apps.