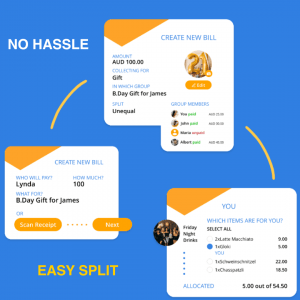

Youchamp is a bill-splitting and expense management mobile application that makes sharing expenses a pleasant experience. You can join new groups to split expenses between multiple people. Create custom groups to send instant messages. Use your credit card to pay your share of expenses seamlessly between friends and family members.

Challenges faced by Youchamp App

The brief was to create an easy-to-use mobile app that would help organizers split and manage payments amongst friends and family. In every case study, we found that organizers wanted to avoid having awkward and serious talks when it came to money with their peers. The challenge was to create something that would allow users to organize payments easily, and equally if needed, and make payments without having to leave the app. As well as the opportunity to provide a non-targeted amount. The brief also requested a function that would promote sharing, bring people together and encourage social interaction.

Pertaining to creation

youchamp is the first major application that was fully designed and developed in house by DigiGround as our own product. It all started when we were trying to organize birthday gifts for some friends, and we did not track who had paid what. While at a birthday party, a few of us including Amjad Khanche and myself were discussing the best way to handle this kind of thing in future.

Given that we are an app development company at DigiGround, we decided we would make a simple app for us to use internally to achieve our easy tracking.

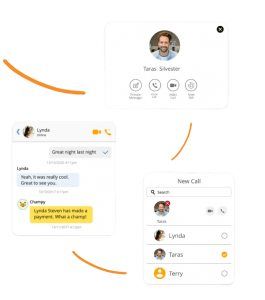

We began to talk about it amongst ourselves and we realized it was an awesome idea to be able to split costs and chat about it, and it would be even better if we could make payments right inside the app. Although there were some similar apps available on the market, none of them suited our needs.

And so, by asking everyone in the Digi Ground team to contribute, we were able to make and launch youchamp in early 2018. Considering all the user feedback and working with our users, we have updated regularly and built the app to be better.

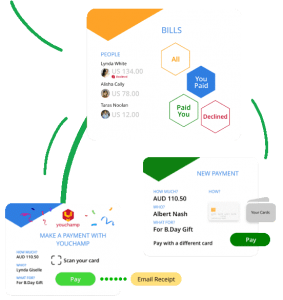

youchamp 2.0 allows users to split payments, chat, send payments directly to people without their bank details, allows recurring expenses to be set up and automatically calculates offset amounts, who owes who what and allows for easy payment.

You can download youchamp now on the App Store and Google Play Store.

Solutions the Youchamp app introduced and expanded on

We exceeded the brief by creating an automatic bill-splitting app that also has a chat service. The idea was to create and capture the entire sharing experience in one app. We added an upload option to share images and other media in the groups. We combined different digital features, including real-time chat, media upload, and bill splitting with the amazing ability to pay friends directly within the app. We made the process of paying back your friends painless by giving users the option of paying by cash, automated bank transfers without exchanging bank details, direct debit, or credit card.

Impact of the app on Australian Market

youchamp provides users with opportunities for increased social connections and new opportunities to create memories. The aim of the app is to take the strain out of discussing finances, which can be an awkward discussion amongst friends and families. It does this by sending friendly notifications for payment follow-up. The function to start new groups creates inclusiveness, which, combined with the chat function, allows for continued social interaction in-app. Local charities can use the app to invite groups, set targets and raise funds. youchamp will simplify their follow-up process and the management of funds.

Key features of the app include:

The ability to start and join new groups to split expenses between multiple people. The option to have no specific target or enter a target amount. Create groups with no target to raise money for charities. Or create a target amount for special occasions, like weddings, or to purchase birthday presents. Create custom groups to send instant messages. Keep socially connected, organize events, and archive them for later reference. Use the chat function to organize events. Keep track of your expenses by attaching notes and images of receipts. You will receive a notification every time someone in your group pays. Track when someone pays, and pay securely within the app by either cash, POLI pay, direct debit or credit card. Contribute to a group without joining the app. Simply pay on the website when you receive the invitation link by SMS from the organizer. Let youchamp app follow up payments, so you do not have to make things awkward between your friends and family. Organize your household bill payments, holidays and gifts, or split dinner bills and anything else you can think of. Get notifications and see clearly how much has been raised and who has contributed.

Awards and recognitions received by Youchamp App

GOOD DESIGN AWARD: 2019 DIGITAL – APPS AND SOFTWARE

GOOD DESIGN AWARD: 2019 DIGITAL – APPS AND SOFTWARE

Blog Posts on:

Conclusion:

The Youchamp journey turns the mundane task of splitting expenses into an adventure worth remembering. No more financial headaches or strained relationships over who owes what. With Youchamp, you are not just dividing bills; you are multiplying the fun, deepening your connections, and making memories that are as priceless as they are hilarious. So, why wait? Dive into the world of Youchamp and let the good times roll – your epic expense-sharing adventure awaits